JAX Finance: What got you interested in FinTech?

Jim Marous: It was a natural progression from my career out of university as a banker. From a beginning in the trenches of a bank branch system in a management training role, to the head of marketing at financial institutions, to a very long role as a strategist and business developer for leading direct and digital marketing agencies that specialized in the banking sector, I continued to shift my role with industry transformation. I began writing articles on retail financial services more than 10 years ago, joining The Financial Brand in 2014 and purchasing and publishing the Digital Banking Report shortly thereafter.

JAX Finance: Do you think the phrase “evolve or die” describes banks’ situation right now?

Marous: The phase has been used to describe the need to adjust to market changes since the beginning of my career over 30 years ago. Most organizations could ‘dodge the bullet’ because it is so difficult for a consumer to switch providers and since almost all financial institutions provided a similar (suboptimal) experience. I believe the “evolve or die” phrase may be more true today than ever before because of the increasing comfort with digital channels, the power of data and advanced analytics and the expectations set by organizations outside the banking industry (Google, Amazon, Facebook, Apple and Uber). Our research has shown that the disparity between big and small organizations in customer satisfaction is increasing due to an inability for many firms to keep pace with changes in mobile banking, product development, customer experience and the ability to personalize.

I believe the “evolve or die” phrase may be more true today than ever before because of the increasing comfort with digital channels, the power of data and advanced analytics and the expectations set by organizations outside the banking industry (Google, Amazon, Facebook, Apple and Uber).

JAX Finance: Does FinTech still deserve the label “disruptive” or has it outshined this tag?

Marous: The term FinTech may have outlived its usefulness, or at least be weakened by overuse, since the industry is using the term to describe not only new start-up firms but also the entire concept of financial services innovation. In addition, the connection between ‘FinTech’ and ‘disruption’ is often misused since most new services are more of an evolution of what has been done in the past as opposed to a revolution in banking. Both terms are great descriptors, but using them together is often done in error.

JAX Finance: What are the biggest (and most important) trends in FinTech right now?

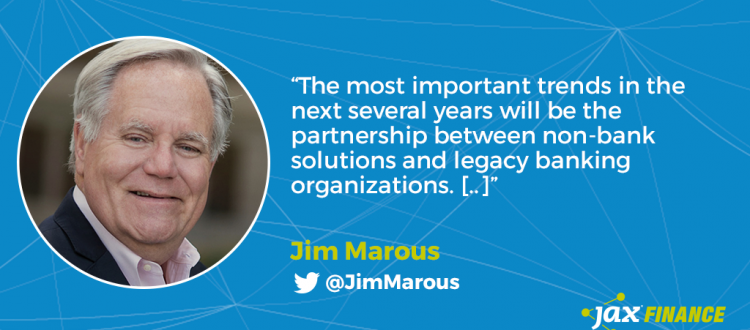

Marous: The standout solutions that are the most important have focused on the use of data and advanced analytics to improve the customer experience. The consumer is not looking for a new lending product – they are looking for a solution that will anticipate their need and provide the most seamless way to act on that need … in real time. The challenge is to not only change the delivery of the service, but to reinvent all that happens behind the scene to improve the digitalization of the entire operation. The most important trends in the next several years will be the partnership between non-bank solutions and legacy banking organizations, the continuing change in regulations, and the transformation of delivery from consumer requested solutions to predictive delivery by providers. While subtler, the industry will begin to deliver on the consumer demands of “know me, look out for me and reward me” in real time.

The most important trends in the next several years will be the partnership between non-bank solutions and legacy banking organizations, the continuing change in regulations, and the transformation of delivery from consumer requested solutions to predictive delivery by providers.

JAX Finance: Do you think the investment potential will attract entrepreneurs to FinTech?

Marous: There is a challenge between the desires of investors (who want quick and significant returns) and most FinTech solutions (which need to meet regulatory standards and demonstrate both scaleability and moderation of risk in various rate and competitive environments). There will continue to be movement of capital to support FinTech solutions, but there will be a shift from the speculative nature seen in the past to the realization that FinTech is more of a long-term play.

JAX Finance: How important is blockchain in this equation? Can FinTech help it go mainstream?

Marous: There is still quite a bit of ‘testing the waters’ regarding the use of blockchain. In many situations, blockchain has been a solution looking for a problem. In the future, the most promising use of blockchain will most likely be in universal identity. Privacy and identity fraud is an increasing problem that blockchain may be able to help solve.

JAX Finance: What does innovation mean to you?

Marous: Innovation is the commitment to, and the application of, current and new technology and processes to improve on an existing solution or respond to a current or future need. There is no definitive scaling of how large an innovation needs to be, but there should be a way to measure the impact in monetary terms. An innovation can be as subtle as being able to use a person’s digital address book to populate a P2P transaction or as significant as being able to provide proactive financial and non-financial solutions, using a voice device that will simplify my everyday life. There is no reason my financial services partner couldn’t provide me traditional financial solutions in addition to integrating my personal calendar, travel, entertainment, shopping and social tools.

JAX Finance: What does the future of finance look like?

Marous: The future of finance should extend far beyond traditional financial solutions. It should be the center of my daily life, connecting all elements of my day in a seamless, digital and proactive manner. Leveraging AI, IoT, AR, machine learning and contextual engagement, my financial solutions partner could be in the background of everything I do. I should no longer care about how I pay, save or transfer money. Instead, these processes will work in the background, using my personal goals and behaviors to make my life easier.